DEFINITION:

“Volume Weighted Average Price (VWAP) is a technical analysis tool used to measure the average price weighted by Volume. VWAP is typically used with intraday charts as away to determine the general direction of intraday prices. VWAP is similar to a moving average in that when price is above VWAP, prices are rising & when price is below VWAP, prices are falling VWAP is primarily used by technical analysts to identify market trend.”

Full form of VWAP is Volume Weight Average Price. The average price weighted by volume. VWAP is a trading tool calculated by taking the number of shares bought times the share price & dividing by total shares.

Volume Weighted Average Price is an Indicator, or used for Intraday trading. VWAP equals the dollar value of all trading periods divided by the total trading volume of the current day.

The VWAP appears as a single line on intraday chart (1min,5min,15min & so on), similar to how a moving average looks. The calculation starts when trading opens & when it closes. Because it is good for the current trading day only , intraday periods & data are used in the calculation.

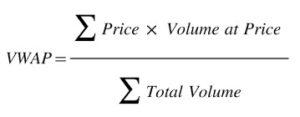

HOW TO CALCULATE VWAP:

VWAP is calculated through the following steps:

- For each period, calculate the typical price, which is equal to the sum of the high, low, and close price divided by three [(H+L+C)/3]. One bar or candlestick is equal to one period. What this period is set at is up to the trader’s discretion (e.g., 5-minute, 30-minute, etc.).

- Take the typical price (TP) and multiply by the volume (V), giving a value TP*V.

- Keep a running tabulation of the TP*V totals as well as a running tally of volume totals. These are additive and aggregate over the course of the day.

- VWAP is calculated by the formula: cumulative TP*V / cumulative volume

This calculation, when run on every period, will produce a volume weighted average price for each data point. This information will be overlaid on the price chart and form a line, similar to the first image in this article.

Moving VWAP is simply adding up various end-of-day VWAP figures and averaging them out over a user-specified number of periods.

VWAP will be calculated automatically in one’s charting software. There should be no mathematical or numerical variables that need adjustment. On the moving VWAP indicator, one will need to set the desired number of periods.

HOW TO ANALYSIS VWAP:

VWAP initiate at the opening price level, & will move up or down with price movement & volume as the session continues. It can help to eliminate a lot of the noise within a stock throughout the day, even more so than a moving average would. It is compared at time to a moving average, & though it shares similarities, they are not the same.

It’s said when price is below the indicators, the stock is in downtrend or there is a downtrend bias to the day and when price is above the indicator, the stock is a uptrend.

Find the average price the stock traded at over the first five-minute period of the day. To do this, add the high, low, and close, then divide by three. Multiply this by the volume for that period. Record the result in a spreadsheet, under column PV.

Divide PV by the volume for that period. This will give the VWAP value.

To maintain the VWAP value throughout the day, continue to add the PV value from each period to the prior values. Divide this total by total volume up to that point. To make this easier in a spreadsheet, create columns for cumulative PV and cumulative volume. Both these cumulative values are divided by each other to produce VWAP.

VWAP Pullback Entry:

Entry Option 1 – Aggressive Traders

Wait for a break of the VWAP and then look at the tape action on the time and sales.

You will need to identify when the selling pressure is spiking, and the tape is going crazy.

This, my friend, is more art than science and will require you to practice reading the tape.

The goal is to identify when the selling pressure is likely to subside and then enter the trade.

This approach will break most entry rules found on the web of simply buying on the test of the VWAP. The problem with this approach is you don’t know if the price will breach the VWAP by 1% or 4%.

I learned the hard way, and if the VWAP were at $10, I would place my limit order at $10. At times there were traders who couldn’t care less about the VWAP, and it would slice through the indicator with such swiftness, the lasting sting to my psyche persists until this day.

This technique of using the tape is not easy to illustrate looking at the end of day chart. You will need to practice this approach using Tradingsim to assess how close you can come to calling the turning point based on order flow.

VWAP Breakout Entry:

Entry Option 2 – Risk Averse Traders

This is what I would recommend to traders that are new to the VWAP indicator.

Essentially, you wait for the stock to test the VWAP to the downside. Next, you will want to look for the stock to close above the VWAP.

You will then place your buy order above the high of the candle that closed above the VWAP.

While this is a more conservative approach for trade entry, it will open you up to more risk as you will likely be a few percentage points off the low.

You will need to determine where you are in your trading journey and your appetite for risk to assess which entry option works best for you.

It goes without saying that while we have covered long trades; these trading rules apply for short trades, just do the inverse.