Godrej Consumer Products has a market cap of ₹1,06,393 crore, but its financials do not look particularly strong. If we analyze its valuation, the EPS is -₹4.43, yet the P/E ratio has surged to 61.7, significantly higher than the industry average of 32.7. This suggests that investors are putting money into the stock based on future expectations rather than strong financial performance. Additionally, the company’s operating margin has remained stable without any significant improvement.

Stock Price Growth vs. Financial Performance

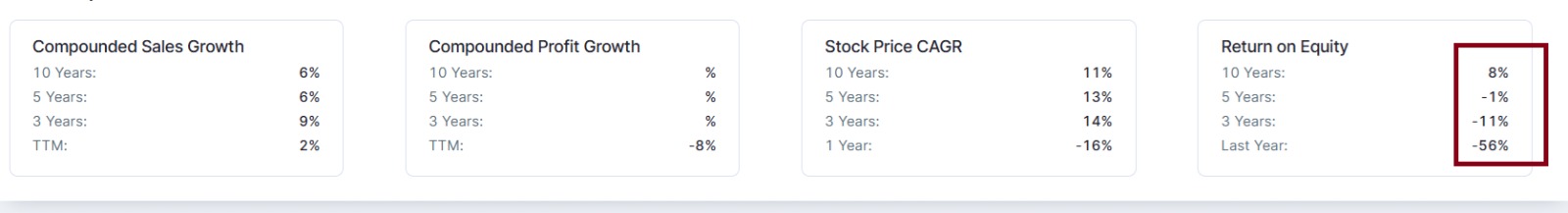

While the stock has shown strong CAGR growth, its sales growth, profit growth, and ROE (Return on Equity) are not as impressive. If stock prices continue to rise without corresponding growth in sales and profits, it indicates that the valuation is not justified—potentially signaling overvaluation.

Rising Debt and Capital Expenditure – A Concern?

The company’s borrowing has increased significantly, which could be a red flag. Borrowings increased from ₹1,130 crore in March 2023 to ₹3,222 crore in March 2024.

The company is also making capital expenditures, which could drive future growth, but if returns do not materialize, financial pressure may increase.

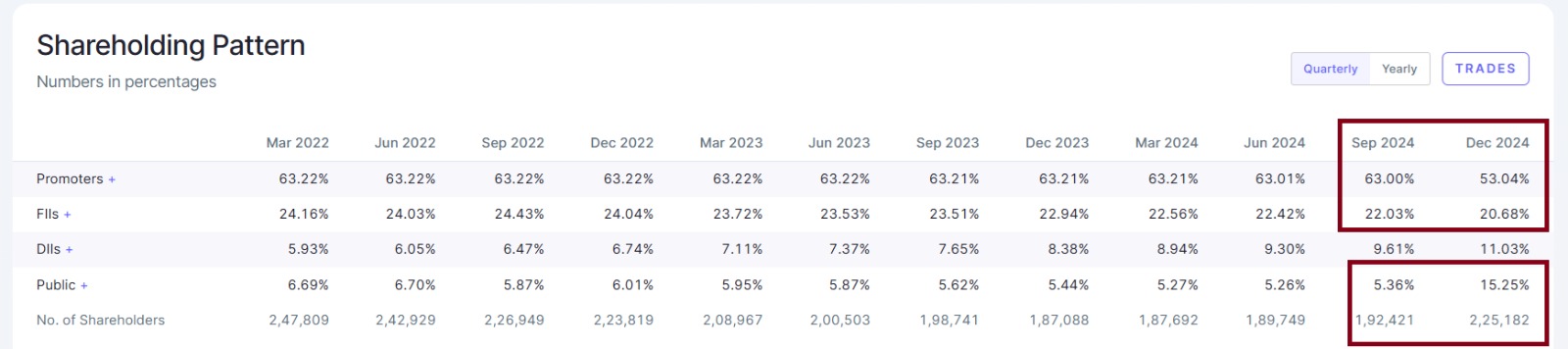

Declining Promoter Holding – A Warning Sign?

Another major concern is the reduction in promoter holding.

Promoter holding dropped from 63% in September 2024 to 53.04% in December 2024—a 10% sell-off.

FII holdings have also decreased by 2%, while the public has been aggressively buying the stock.

Promoter Selling – A Negative Signal?

When a company’s promoters sell a significant stake, it is often considered a negative signal, as they have the best insight into the company’s real position. While many promoters are increasing their stakes in other companies, Godrej Consumer’s promoters have offloaded a significant portion, raising caution.

Conclusion – Should Retail Investors Be Careful?

High P/E with weak financials – The stock is expensive, but the company’s actual performance does not justify it.

Rising debt – If growth does not materialize, financial pressure will increase.

Promoter selling – A significant reduction in promoter holding is a red flag.

FII reducing stakes – Large investors are also cautious about the stock.

Retail investors should avoid rushing into this stock and closely monitor the company’s future performance. Factors like promoter selling, rising debt, and overvaluation must be carefully considered before making an investment decision.